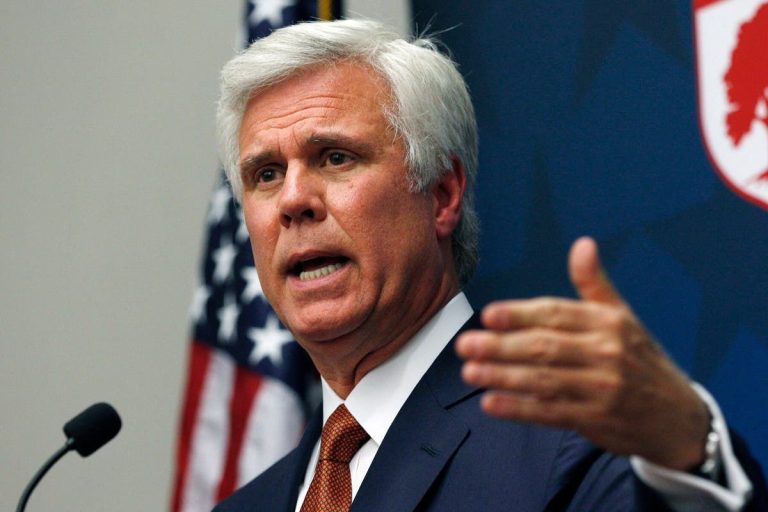

Governor Phil Murphy delivered his ninth and final budget address on Tuesday, presenting a $58.05 billion Fiscal Year 2026 budget that aims to expand affordability, support the next generation, and maintain fiscal responsibility. The budget includes record-breaking property tax relief, increased school funding, and a $6.3 billion surplus, ensuring New Jersey is “stronger, fairer, and more prepared for the future.”

“Over the past seven plus years, we have made historic progress in advancing this mission, but we’re not done yet,” Governor Murphy said in his address. “Our absolute top priority—as it has been since day one—is delivering economic security and opportunity to every New Jerseyan.”

The budget proposes nearly $4.3 billion in direct property tax relief, making it the largest tax relief package in the state’s history. Key initiatives include $600 million for the Stay NJ program, aimed at lowering property taxes for over 432,000 senior homeowners, $2.4 billion for the continuation of the ANCHOR program, benefiting over two million homeowners and tenants, and $239 million for the Senior Freeze program, helping over 235,000 taxpayers. The Murphy administration has more than doubled direct property tax relief compared to previous administrations.

Murphy’s budget also provides a record $12.1 billion in K-12 school funding, a $3.9 billion increase since 2018. Other education investments include a $1.27 billion expansion of preschool education, legislation requiring full-day kindergarten in every school district, $7.5 million for high-impact tutoring grants, and $3 million for schools that adopt phone-free learning environments. The governor assured that no school district will see a steep drop in aid, with funding caps ensuring that reductions in key aid categories do not exceed three percent year-over-year.

The budget includes a fifth consecutive full pension payment of $7.2 billion, continuing Murphy’s push to fully fund the pension system after years of underfunding by previous administrations. The administration’s pension contributions under Murphy now total $47 billion—nearly four times the combined contributions of the previous six governors. Additionally, the budget proposes a $6.3 billion surplus, 15 times greater than what Murphy inherited. It also includes $815 million for NJ TRANSIT, with funding from the Corporate Transit Fee, and nearly $2 billion in spending reductions, with total appropriations $70 million less than the previous year. Murphy also announced a plan to close East Jersey State Prison, saving taxpayers $30 million in 2026 and another $20 million in 2027.

The budget includes new tax increases on real estate transfers, sports betting, alcohol, adult-use marijuana, and cigarettes. However, it also introduces sales tax exemptions for baby items such as cribs, car seats, and strollers, as well as for sunscreen.

Recognizing New Jersey’s role as a major transportation hub, the budget includes $1.23 billion for state and local highway and bridge projects and $767 million for NJ TRANSIT capital improvements. It also allocates $20 million for Strategic Innovation Centers, which have already attracted over $250 million in private sector investment.

Murphy’s budget invests in clean energy, setting aside $50 million for the Charge Up NJ program, moving the state closer to its 100 percent clean electricity by 2035 goal. The legal cannabis industry, which generated over $1 billion in sales in 2024, is projected to contribute $90 million in tax revenue this year.

With this budget, Governor Murphy aims to leave his successor with a financially stable state, a historic surplus, and robust economic programs that have reshaped New Jersey’s economy. “We are in a far better place than we were when we started,” Murphy concluded. “And the work will continue to make New Jersey the best place to live, work, and raise a family.”