Pantaleo “Leo” Pellegrini, the former Hoboken Director of Health and Human Services and Director of the Department of Environmental Services, pleaded guilty today to charges of embezzlement and filing a false tax return. The plea was entered before U.S. District Judge Michael E. Farbiarz in Newark federal court.

Scheme to Defraud the City of Hoboken

Pellegrini admitted to embezzling funds from the City of Hoboken while serving in his official capacities. According to court documents and statements made during the hearing, Pellegrini diverted payments intended for the city to bank accounts he controlled. Additionally, he submitted invoices for personal business expenses, which the city unknowingly paid. He failed to report the embezzled funds on his tax returns, resulting in the filing of a false personal tax return.

As a senior city official, Pellegrini had oversight of several divisions, including Cultural Affairs, Health, Parks and Recreation, Rent Leveling and Stabilization, and Senior Services. His responsibilities also extended to managing public recreational facilities, such as soccer fields used for both youth and adult soccer leagues.

Misappropriation of Soccer League Funds

Prosecutors revealed that Pellegrini devised a scheme to divert participant fees from an adult soccer league into a business account he controlled, registered under a soccer-related entity linked to him. He instructed an associate, identified in court documents as “Individual-1,” to leave checks for facility rentals blank, which he later filled in with the name of his entity. These checks were deposited into Pellegrini’s account without the associate’s knowledge.

Pellegrini also exploited his role as owner and president of a private travel soccer club by submitting fraudulent invoices to the city. These invoices misrepresented private club expenses as eligible for city reimbursement, resulting in tens of thousands of dollars being paid to Pellegrini and his vendors.

Tax Evasion

In addition to embezzling city funds, Pellegrini admitted to omitting the illicit income from his tax returns. This deliberate omission understated his income and violated federal tax laws.

Potential Sentencing

Pellegrini faces significant penalties for his crimes. The charge of embezzlement carries a maximum sentence of 10 years in prison and a fine of up to $250,000 or twice the financial impact of the crime. The charge of filing a false tax return carries a maximum sentence of three years in prison and a similar fine. Sentencing is scheduled for April 29, 2025.

Investigation and Prosecution

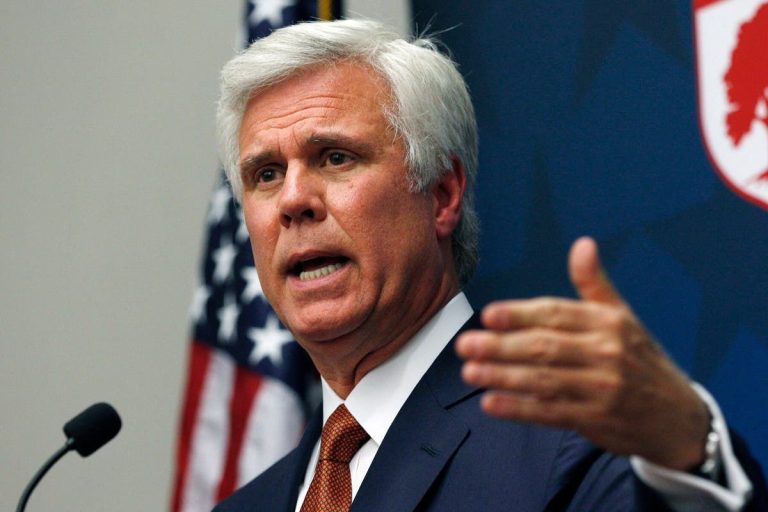

The case was investigated by special agents from the FBI, led by Acting Special Agent in Charge Nelson I. Delgado, and agents from IRS-Criminal Investigation under the direction of Special Agent in Charge Jenifer L. Piovesan. U.S. Attorney Philip R. Sellinger praised their efforts in uncovering Pellegrini’s scheme.

The prosecution is being handled by Assistant U.S. Attorneys Mark J. McCarren and Matthew Specht of the Special Prosecutions Division.

Pellegrini’s guilty plea marks a significant step in addressing corruption within local government. The court will determine his fate during sentencing next year.